Direct Mail Volume & Trends Report: Q4 2023

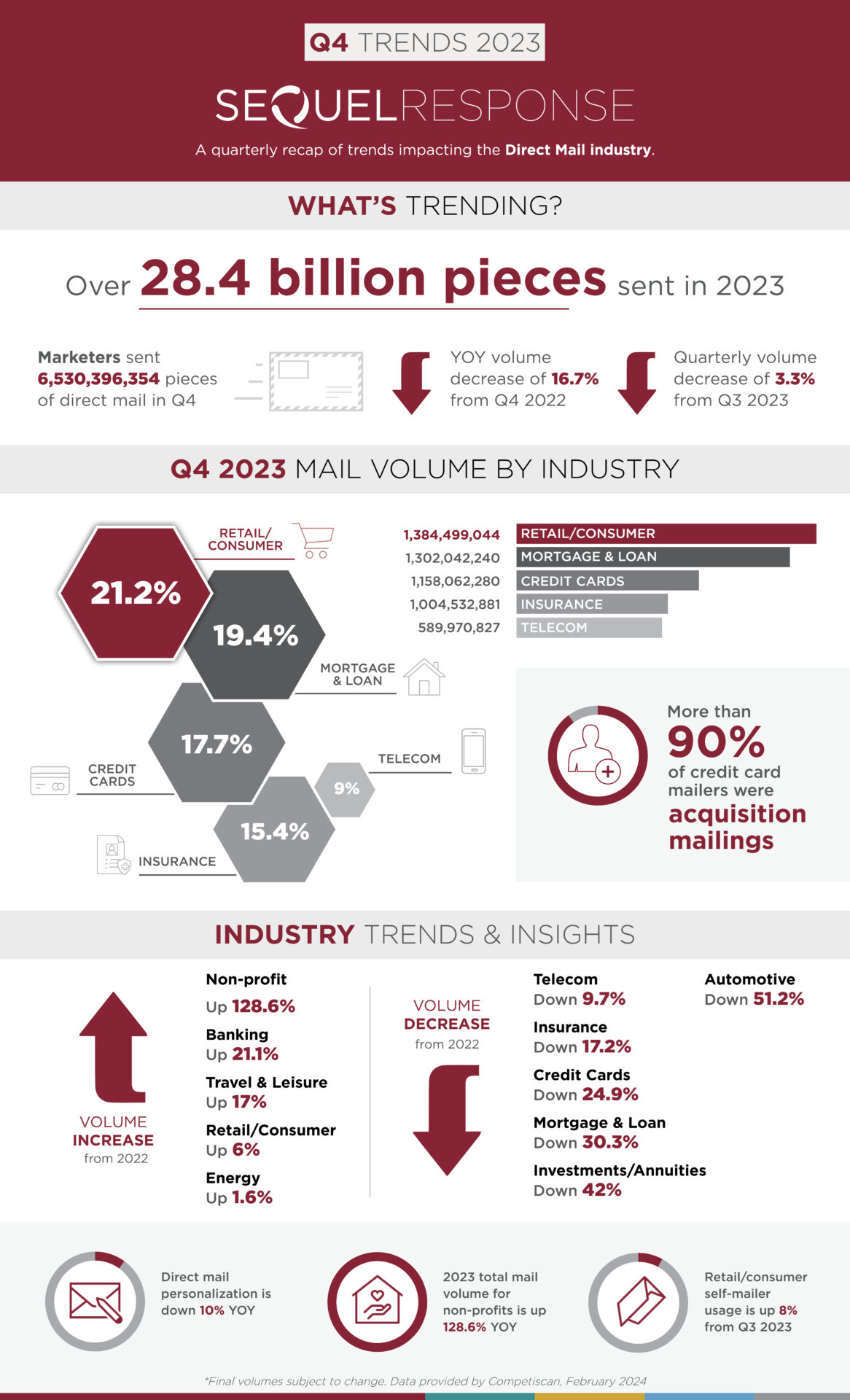

Early industry data from Competiscan shows direct marketers mailed more than 6.5 billion pieces in Q4 2023 – a slight decrease of 3.3% from Q3 2023. This brings 2023’s total marketing direct mail volume to 28.4 billion* pieces.

This Quarter’s Direct Mail Volume & Trends

In Q4 2023, retail/consumer services jumped up to replace credit cards as the top mailer, accounting for 21.2% of total direct mail volume. The mortgage/loan sector showed growth as well, up 20.4% from Q3 and down only 6% from 2022’s fourth quarter. Softening interest rates had an impact on the credit card industry, with mail volume down 25% YOY but on the upswing with 8% growth over Q3. The non-profit sector experienced a substantial increase in yearly volume of 128.6% from 2022, which could be attributed to heightened donor engagement.

A closer examination of direct mail trends shows there were strategic shifts in package types as brands geared up for peak shopping season. Across all industries, brands pivoted away from envelopes and toward postcards. This shift could be in an effort to save on production and postage costs or to ensure that marketing messages are more visible in a season when consumers are actively looking for savings and offers. Retail/consumer services specifically embraced an 8% increase in self-mailer usage from Q3 2023 and a 6% increase YOY. There’s also an indication that marketers are increasingly averse to paying for digital print with inflationary pressures mounting, as personalization on direct mail pieces has consecutively decreased for five straight quarters.

“High inflation rates and economic uncertainties impacted industry volumes this year,” explained Patrick Carroll, Director of Strategy at SeQuel Response. “Despite dealers having cars on lots unlike in 2022, the automotive industry’s mail volumes were cut in half YOY. The insurance industry also typically sees a strong fourth quarter, but this year, we observed a 34% drop compared to 2022, raising concerns about the future of Annual Enrollment Period (AEP) mail. On the other hand, the mortgage/loan, non-profit, travel, and credit card sectors all experienced an uptick in quarterly volumes, suggesting that direct mail is opening new doors for financially recovered brands.”

The infographic below shares additional information on Q4 2023 direct mail performance.

You can find more direct marketing resources and industry insights on our blog, including the latest direct mail research, and tips on how to push beyond traditional direct mail in 2024.

Data provided by Comperemedia, February 2024

*Volume projections are based on a stratified sampling scheme that ensures a balanced calculation, representative of the US Census across different age groups, geographical locations, income levels, and home ownership status.